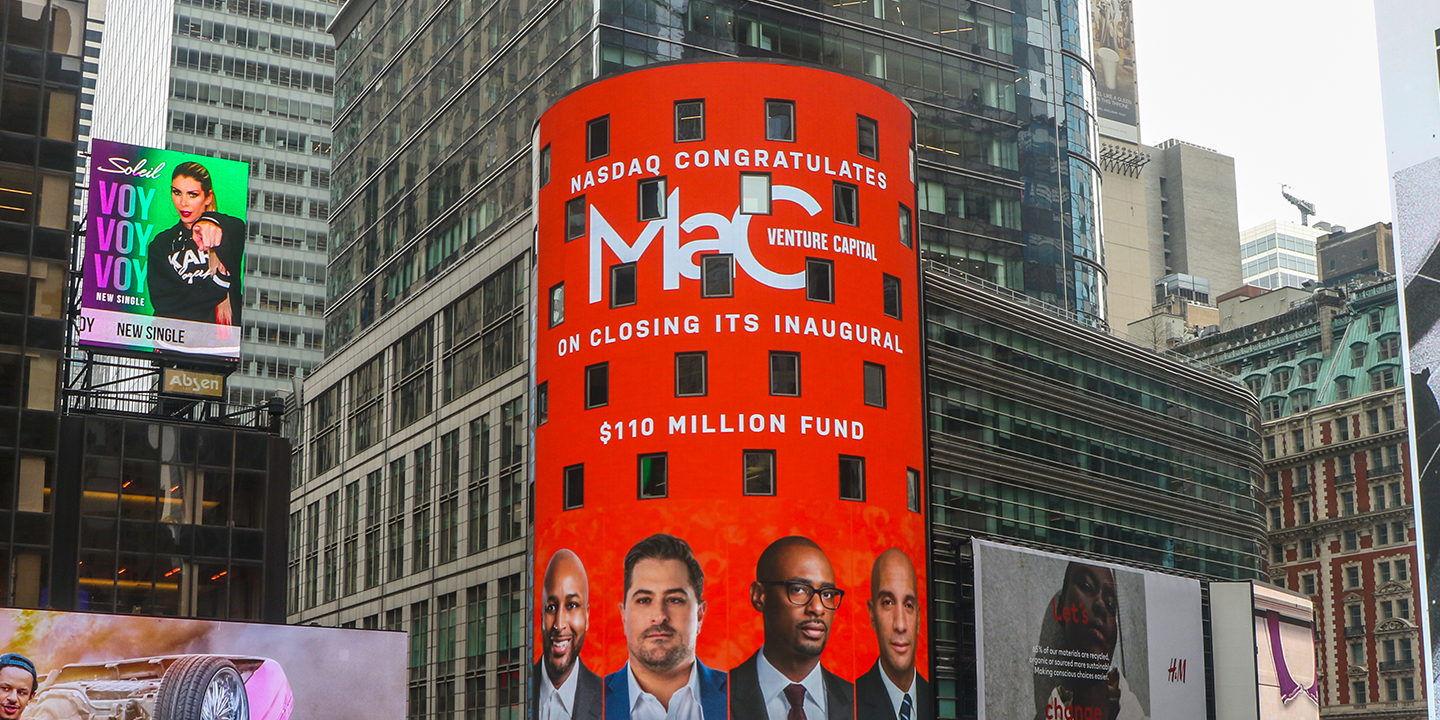

While tech startups have been responsible for evolving and innovating the way we live, work, and communicate, there’s still a major problem the industry hasn’t been able to shake—a serious lack of diversity. MaC Venture Capital, and their inaugural $110M fund, is bringing long-overdue change by actively using a wider investment lens that supports entrepreneurs from all backgrounds and demographics to change the world of venture capital.

- Media Relations

Between our deep background working with venture capital firms like a16z and Forerunner, and our relationships with diversity-focused business reporters, we knew that we could launch MaC VC into the venture capital scene and put them on the radar of the right entrepreneurs.

As the first majority Black-led VC firm to raise an inaugural $110M fund, we needed to distinguish MaC VC from other firms, including those that are also minority-led, with the goal of telling their story in the right way.

By working closely with all four of their GPs to focus on what makes them different, we came to see that they represented a new kind of VC firm, one with a portfolio invested in 76% diverse and women founders, amplifying companies that typically wouldn’t be seen at any other firm.

Relying on this as the foundation of our messaging architecture, we hosted a media training with the GPs to prepare them to communicate how their cultural investment lens is their superpower in identifying emerging shifts in culture, and how consumers and companies must shift with them.

Our strategy focused on pre-briefing reporters and media ahead of the launch, which resulted in 19 stories and 3 broadcast segments in Business Insider, Fast Company, Forbes, TechCrunch, WSJ, and appearances on CNBC, Cheddar, and the Fortt Knox podcast among others.

The news even caught the attention of LinkedIn’s editors, who ran a featured story that compiled the many related posts about the launch.

The success of the launch is evidence of how MaC VC is changing the future of venture capital, proving that diversity is our strength—especially when it comes to investing in the future.